Why Uranium Is the Answer

Listen up, uranium charts just might be pointing towards a potential breakout. But before we dive into the charts, let’s discuss why. Nuclear energy is a controversial topic, with some advocating for its use as a clean and reliable power source, while others warn of radiation dangers and potential disasters. However, there’s no denying that nuclear energy is the future. Some argue that renewable energy sources like solar and wind are the way to go, but let’s be realistic – they don’t have the same level of power as nuclear energy. Have you ever witnessed a solar panel meltdown? Unlikely. But you have likely seen solar panels malfunction, causing problems on the grid. And let’s be honest, solar energy is as thrilling as watching paint dry.

But nuclear energy? Now that’s something to get excited about. It’s like a superhero in energy form – clean, reliable, and consistent. It’s the Iron Man of energy sources. And let’s not forget, it’s low-carbon. So, while your friends drive around in their Priuses feeling self-righteous about their “green” lifestyles, you can sit back and enjoy the fact that you’re powering your home with nuclear energy and saving the planet at the same time. #winning

Nuclear Energy Is a Clean Reliable Energy Source

One of the biggest advantages of nuclear energy is that it is a low-carbon energy source. Unlike fossil fuels, nuclear power plants do not produce any carbon emissions. This makes nuclear energy an important tool in the fight against climate change and a key component of any strategy to reduce our dependence on fossil fuels.

Another important benefit of nuclear energy is that it is a reliable and consistent source of power. Unlike renewable energy sources like solar and wind, which can be affected by weather conditions, nuclear power plants are able to operate at a consistent level of output, providing a steady stream of electricity. This makes nuclear energy particularly well-suited for baseload power, which is the minimum amount of power that must be available at all times to meet the needs of a given system.

Is Nuclear Energy Safe?

And don’t even get me started on the risks of nuclear energy. Sure, there’s the possibility of a nuclear accident, but that’s like saying there’s a chance you’ll get struck by lightning. It’s rare and it’s not going to happen to you. Plus, with the development of Small Modular Reactors, we’re making nuclear energy even safer.

Conclusion

So, let’s cut to the chase. Nuclear energy is the future and there’s nothing anyone can do to stop it. So, you can either get on board and join the winning team or you can keep using your little solar panels and wind turbines and be left in the dust. The choice is yours. But, if you ask me, the smart choice is obvious. Nuclear energy for the win.

With that rant outta the way. The above spiel implies that the demand for uranium, the fuel source for nuclear power plants, is poised for growth. As the demand increases, so will uranium prices and the worth of uranium stocks. Industry experts forecast that we are approaching a uranium bull market, and the charts below suggest a breakout could be near.

Cameco Corp. (TSX:CCO)

Cameco is accelerating higher off the lower trendline of a giant ascending triangle continuation pattern. Monitor for continued upside momentum and a price move back towards the upper trendline of the pattern. This technical setup is considered to be very bullish because it suggests that buying pressure is increasing, and the price may break out above the triangle to the upside.

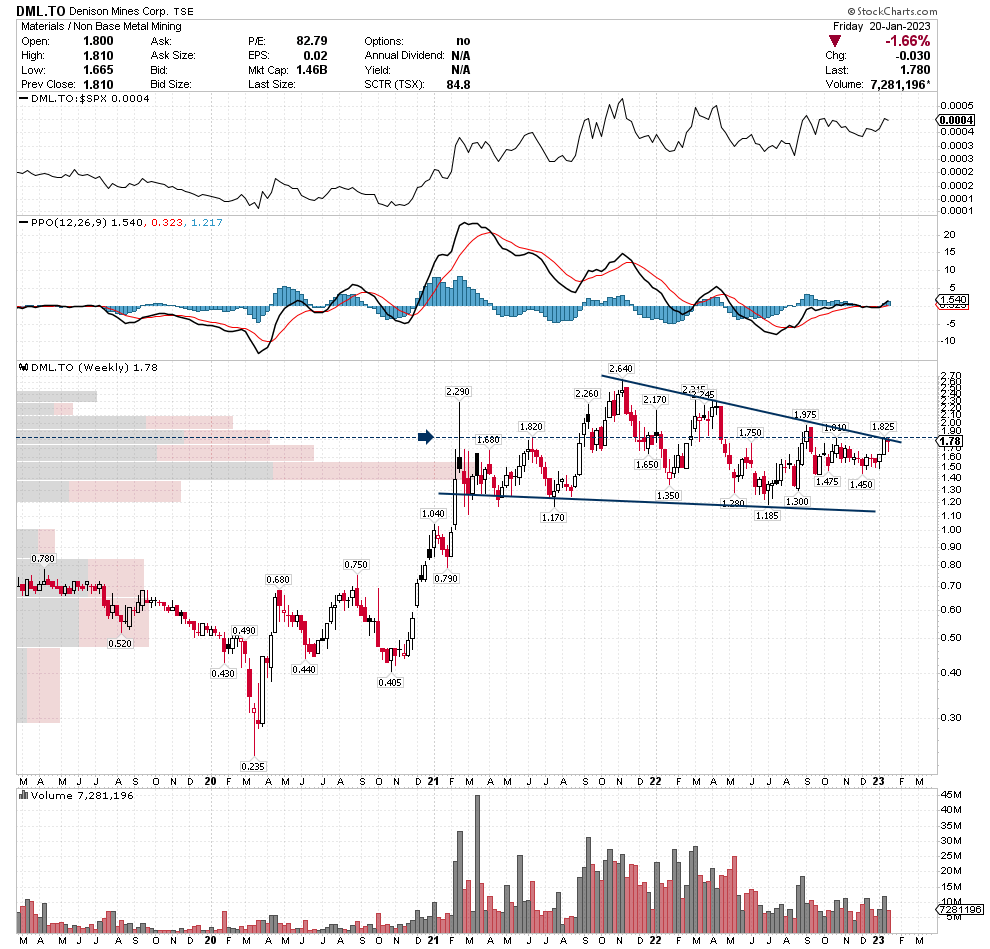

Denison Mines Corp. (TSX:DML)

Denison Mines is pushing up against the upper trendline of a giant falling wedge continuation pattern as the weekly PPO indicator moves above the zero line, signaling a shift in momentum. Watch for a breakout to occur. As the saying in technical analysis goes, “the bigger the base, the higher into space.”

Energy Fuels, Inc. (TSX:EFR)

Energy Fuels appears to be setting up at the right side of a multi-year basing pattern. Monitor for upside momentum.

Global Atomic Corporation (TSX:GLO)

Global Atomic has worked itself to the apex of a multi-year basing pattern. When the price gets tight on the right side of a chart pattern, it is considered bullish because it indicates that volatility has fallen to low levels while the stock in question enters a narrow trading range. According to John Bollinger, periods of low volatility are often followed by periods of high volatility. So, with that said, watch for a breakout, as it would be considered extremely bullish and suggest the beginning of an uptrend.

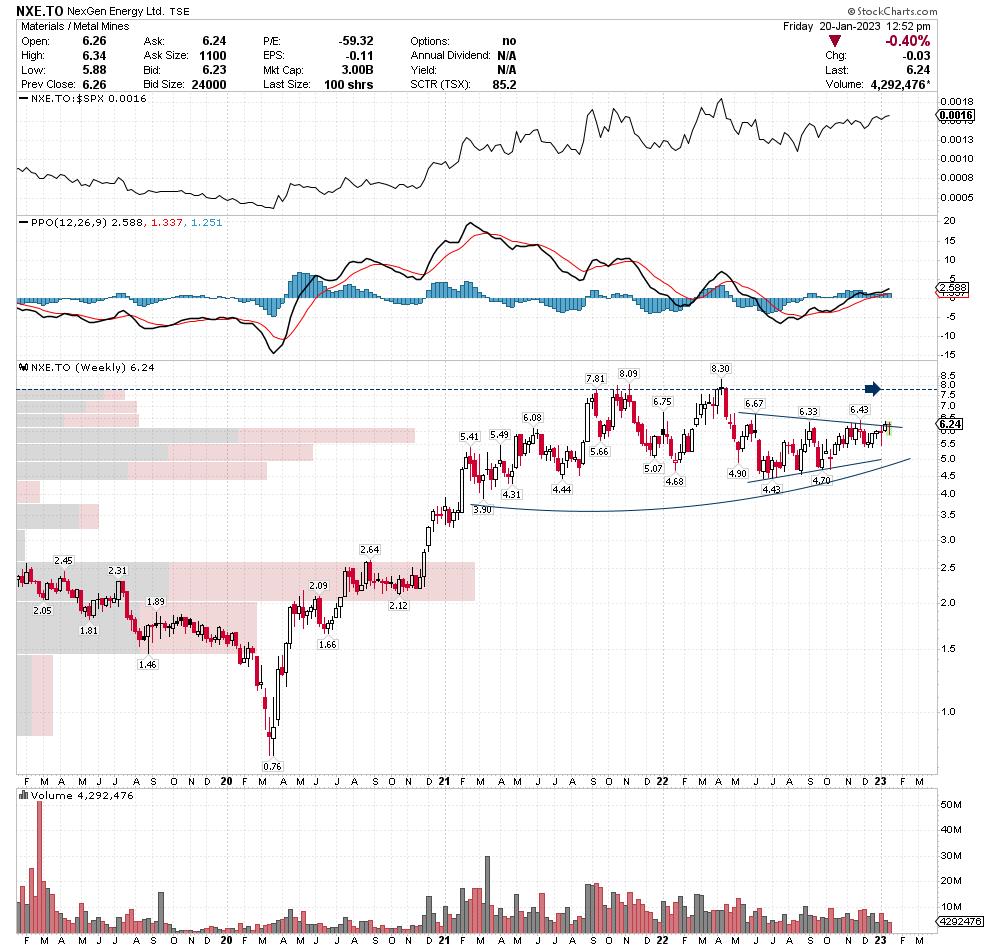

NXE.TO – NexGen Energy Ltd.

NexGen Energy appears to be setting up at the right side of a giant multi-year basing pattern. Monitor for upside momentum.

U/UN.TO – Sprott Physical Uranium Trust

The Sprott Physical Uranium Trust has worked its way to the apex of a giant consolidation/continuation pattern. Monitor for a breakout. As suggested above, a breakout from this technical chart configuration would be considered extremely bullish and suggest a continuation of the uptrend.

URNM – Sprott Funds Uranium Mining ETF

The Sprott Uranium Mining ETF appears to be setting up in the form of a giant falling wedge-type continuation pattern, which is located below a major horizontal resistance line. Take note of the large volume by price bar, which suggests a high level of accumulation as the price pushes up against the resistance level. A technical breakout from this chart configuration would be considered extremely bullish and suggest a continuation of the uptrend.

And if you liked this blog post, share it with a friend! Or don’t, we don’t really care. But either way, don’t forget to keep a few uranium stocks on your watchlist.

To learn more about chart patterns and how to trade them, visit our education section by clicking HERE.

Get new posts delivered straight to your inbox by signing up below: